The Impact Of Inflation On The 2025 Tax Brackets. The irs has released the updated tax brackets for the 2025 tax year, reflecting changes due to inflation adjustments. Here’s what you need to know select looks at the irs’s latest changes to the marginal income tax brackets.

After the 2025 tax bracket changes, more income is falling into lower tax brackets, potentially leading to lower taxes for many canadians. The inflation adjustments mean that taxpayers will need to earn more to hit a higher tax rate. The budget deficit is lower at 5.1% of gdp for fiscal 2025, from 5.8% in fiscal 2025 and hinges on curtailed revenue spends and improving tax collections.

In his opinion piece, mr taylor cited australia’s national accounts as the source for his record 27 per cent tax figure.

Tax filers can keep more money in 2025 as IRS shifts brackets The Hill, We’re going to start with comparing the 2025 and 2025 tax brackets.

2025 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, In a move reflecting modest inflation, the irs announced minimal changes to the top marginal tax.

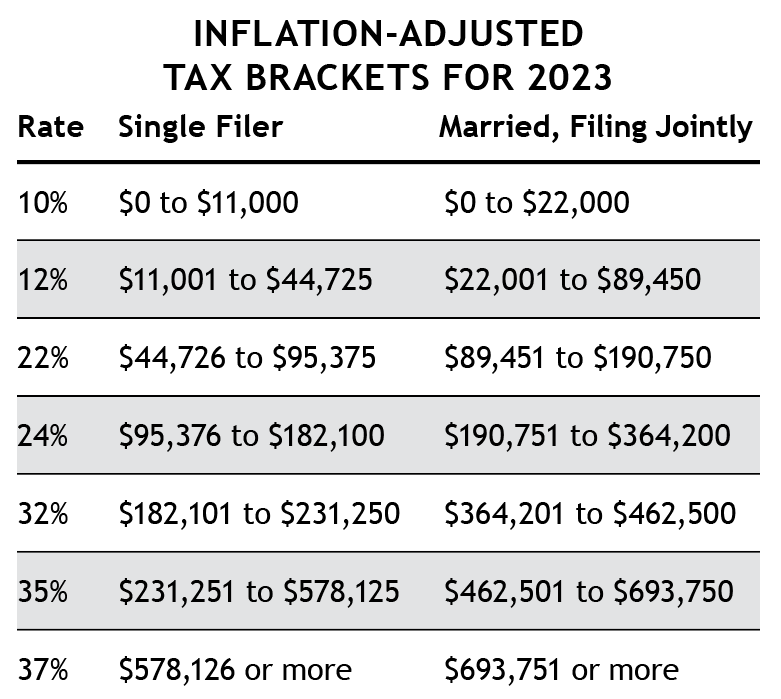

Tax Brackets for 20232024 & Federal Tax Rates (2025), Here’s what you need to know select looks at the irs’s latest changes to the marginal income tax brackets.

Listed here are the federal tax brackets for 2025 vs. 2025 FinaPress, In october, the irs announced its annual adjustments to the standard deduction and tax brackets for the 2025 tax year.

IRS announces inflation adjustments for standard deduction, tax, In october, the irs announced its annual adjustments to the standard deduction and tax brackets for the 2025 tax year.

InflationAdjusted Tax Provisions May Boost Your 2025 TakeHome Pay, The alternative minimum tax exemption is set to increase to $85,700, up from $81,300, and will begin to phase out at $609,350 in 2025, instead of the 2025 rate.

2025 tax brackets IRS inflation adjustments to boost paychecks, lower, The table below shows the personal income tax rates for 2025/25, as well as the rebates and thresholds.

IRS Tax Brackets AND Standard Deductions Increased for 2025, In this article, we will delve into the details of the new tax brackets for 2025 and explore what these changes mean for clients.

What’s My 2025 Tax Bracket? Lee, Nolan & Koroghlian, 9, 2025 washington — the internal revenue service today announced the annual inflation adjustments for more than 60 tax provisions for tax year.

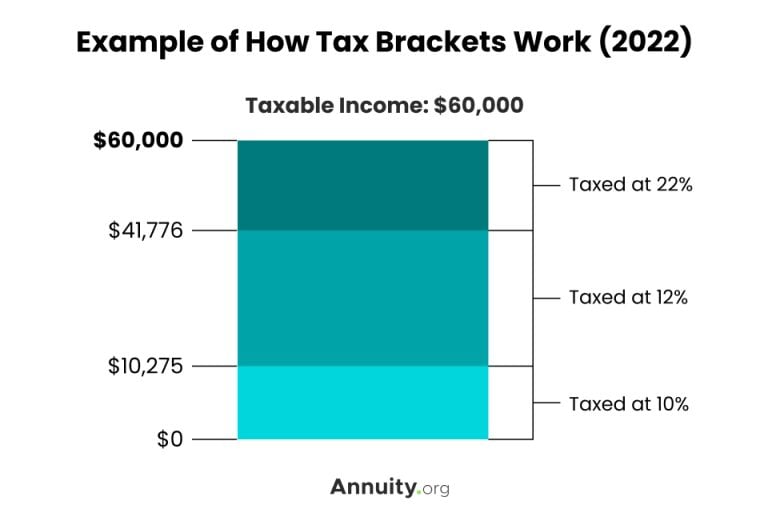

This means you get to keep more money before paying taxes. The highest earners fall into the 37% range, while those who earn the least are in the 10%.